How to Shop for Car Insurance (And Compare Quotes Effectively)

Whether you're buying a car, moving to a new state, or simply trying to cut expenses, shopping for car insurance can feel overwhelming. With dozens of providers, coverage levels, and pricing options, how do you choose the right policy? The good news is, with the right approach, you can find the best deal without sacrificing protection.

Step 1: Know What You Need

Before getting quotes, decide on the coverage you want. Do you need full coverage (liability + collision + comprehensive), or is minimum liability enough for an older vehicle? Think about:

- Your car’s age and value

- Your state’s minimum coverage requirements

- Your risk tolerance and financial situation

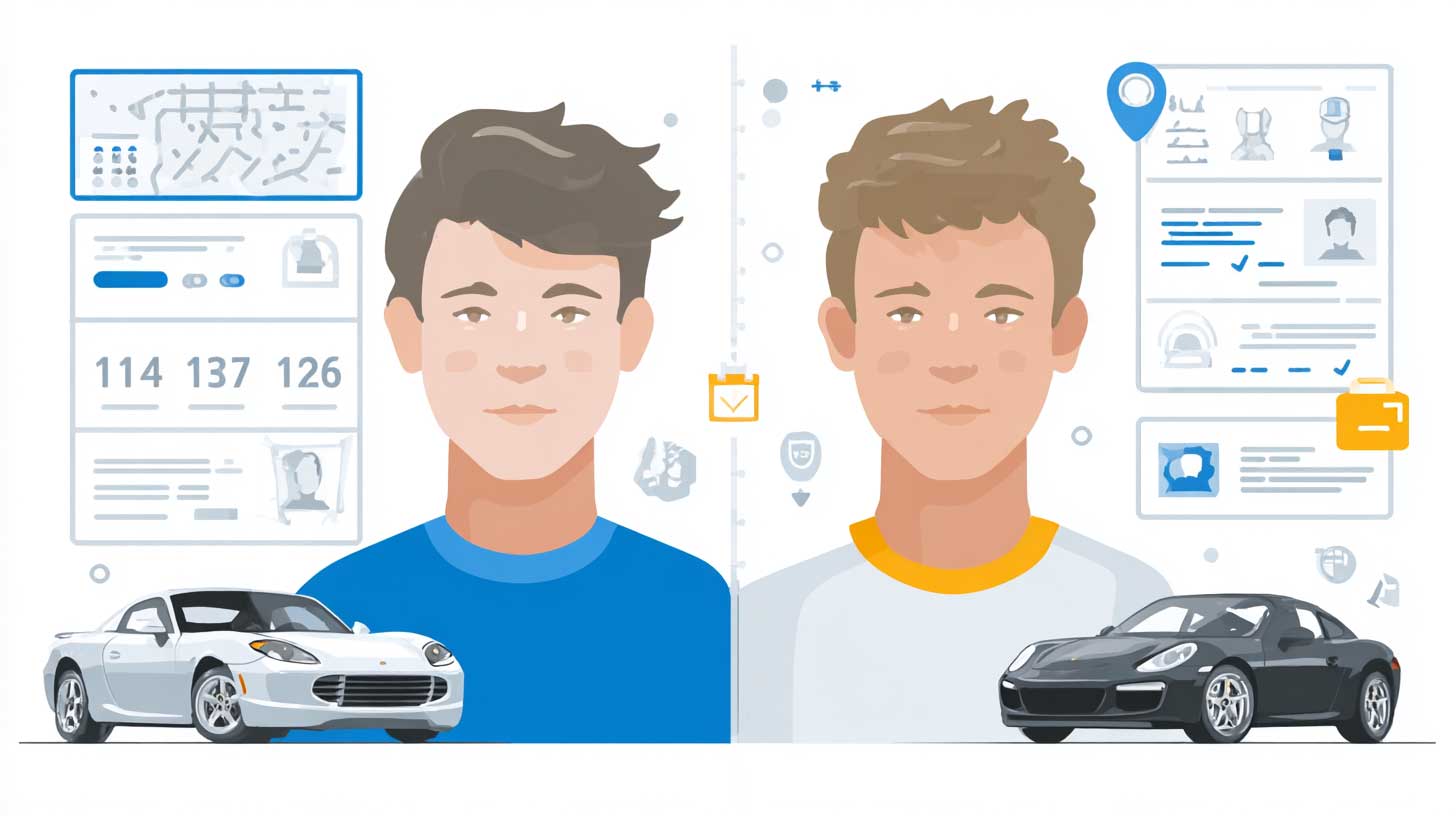

Step 2: Gather Your Information

To get accurate quotes, you’ll need your:

- Driver’s license(s) and VIN(s)

- Current mileage and annual mileage estimate

- Previous insurance policy details (if applicable)

- Driving history (tickets, accidents, claims)

Step 3: Get Quotes from Multiple Providers

Don’t settle for the first quote you get. Rates vary widely—even for the exact same coverage. Get quotes from:

- Big national carriers (Geico, State Farm, Progressive, etc.)

- Regional insurers who may offer better rates in your area

- Insurance comparison websites (but be cautious of lead generators)

Step 4: Compare Apples to Apples

When comparing quotes, make sure you're looking at the same:

- Coverage types (liability, collision, comprehensive, etc.)

- Coverage limits and deductibles

- Policy extras (rental reimbursement, roadside assistance, etc.)

A lower price doesn’t mean a better deal if the coverage is weaker.

Step 5: Look for Discounts

Most companies offer discounts for:

- Bundling auto with home or renters insurance

- Good driving or defensive driving courses

- Low mileage or telematics programs

- Good student or military affiliation

Step 6: Watch for Red Flags

Be cautious of ultra-low quotes—they may have hidden fees or poor claims service. Research companies by checking:

- Financial strength (AM Best rating)

- Customer service reviews

- Claims satisfaction rankings (like J.D. Power)

Step 7: Don’t Forget to Re-Shop Annually

Even if you’re happy with your current insurer, rates change every year. Compare quotes annually, especially after major life events—like moving, marriage, or buying a new car.

Taking time to shop smart can save you hundreds per year without sacrificing peace of mind. Next up: We’ll walk you through the **different types of car insurance coverage**, so you know exactly what you're buying—and what you're not.